New Delhi, Apr 19:

Agencies

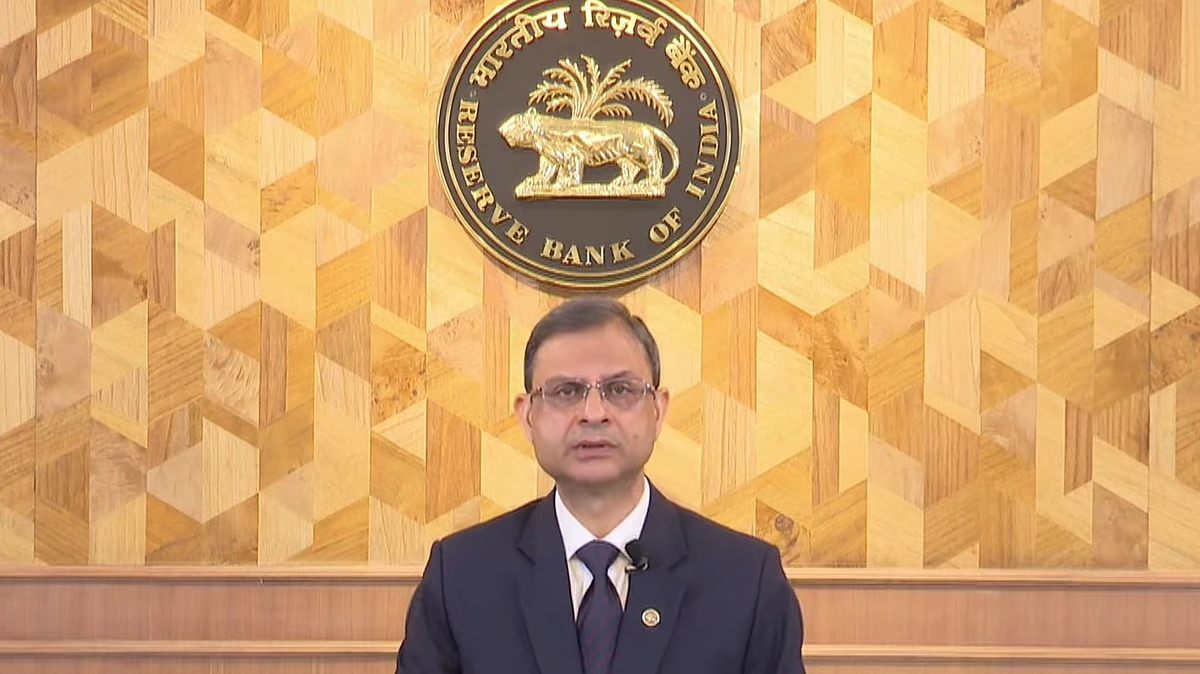

Amid the ongoing tariff war, Reserve Bank Governor Sanjay Malhotra has said that the central bank will continuously monitor the rapidly evolving global situation and remain ‘agile and proactive’ in its policy actions.

Observing that the Indian economy and the financial markets have demonstrated remarkable resilience, Malhotra cautioned that “they are not immune to the vagaries of an uncertain and volatile global environment.” “In view of the rapidly evolving situation, especially on the global front, we are continuously monitoring and assessing the economic outlook. We will be agile and proactive in our actions on the policy front, as always,” he said, while addressing the 24th FIMMDA-PDAI Annual Conference in Bali on Friday.

He said the growth-inflation balance has improved significantly and there has been a decisive improvement in headline inflation which is projected to remain aligned to the target of 4 per cent in FY26.

Global uncertainties and weather disturbances, however, pose risks to the inflation outlook.

“Even though we have projected a somewhat lower real GDP growth for FY26 at 6.5 per cent, India is still the fastest growing economy. Yet, it is much below what we aspire for. We have reduced repo rates twice and provided sufficient liquidity,” he said.

On the Indian financial markets, the Governor said all market segments including FX, G-sec, Money Markets, have largely remained stable. While the rupee came under a bit of pressure a few months ago, it has fared better thereafter and regained some lost ground, he noted.

Equity markets experienced significant correction, as capital outflows accelerated, a trend seen in most emerging markets. The government securities market has, however, remained rock-steady throughout the year.

The gross market borrowings of the central and state governments, totalling Rs 24.7 lakh crore in FY 2024-25, sailed through smoothly, he said.

The cost of borrowing for the central government came down by 28 basis points to 6.96 per cent in FY25, from 7.24 per cent in FY24. The secondary market in g-secs continued to be deep and active, partly aided by India’s inclusion in global bond indices, he added.

In India, Malhotra said markets ha “Even though we have projected a somewhat lower real GDP growth for FY26 at 6.5 per cent, India is still the fastest growing economy. Yet, it is much below what we aspire for. We have reduced repo rates twice and provided sufficient liquidity,”.

He also emphasised that the foreign exchange markets are reasonably liquid with narrow bid-ask spreads and there is growing transparency in this market.

In January 2020, banks were permitted to deal in FX beyond onshore market hours. While volumes are not significant, banks are transacting both prior to and post onshore market hours. Such trading, however, is largely confined to the period immediately before and after domestic FX market hours, he noted.

“Fair treatment of customers and transparency in forex pricing for the smaller and less sophisticated customers continues to engage our attention. Much more can be and needs to be done here. Divergence in pricing in FX markets for the small and large customers are far wider than what can be justified by operational considerations,” he said.

The Reserve Bank has recently announced that access to FX Retail will also be provided through the Bharat Connect platform. In the first phase, a pilot to facilitate purchase of US dollars by individuals is planned. Subsequently, its scope will be expanded based on the experience gained.

“We also continue to see banking channels being used for activities on unauthorized FX trading platforms. This calls for greater vigilance and stronger efforts by banks to create awareness among their customers about the perils of using such platforms,” he said.

The Reserve Bank has been regularly updating the Alert List of unauthorized forex trading platforms and conducting awareness campaigns to educate users.

“Today, financial markets stand at a cusp of transformation between global and domestic headwinds, unprecedented opportunities and growing public expectations. When transformations such as these take place, there are many moving parts which need to come together like the pieces of a jigsaw and many stakeholders who have critical roles to play,” Malhotra said.

He stressed that as India forges ahead to take its rightful place in the emerging global order, financial markets have a crucial role to play.

Financial markets will need to facilitate efficient and cost-effective funding for realising the aspirations of the country, he said. |